Carlton offers comprehensive training programs that empower individuals to excel in trading by teaching advanced analytical tools, strategies, and immersive learning experiences. Participants gain skills in interpreting market data, identifying patterns, and making informed decisions. The program focuses on trend following, risk management, and practical application through simulated trading exercises, enhancing profitability and confidence in navigating volatile markets while learning to trade stocks effectively.

Uncover the secrets to mastering market trends with Carlton’s comprehensive training program. In today’s dynamic financial landscape, understanding market dynamics is crucial for successful stock trading. This guide dives into the proven Carlton approach to unlocking hidden insights. Learn powerful tools and techniques to identify emerging trends, interpret data patterns, and execute profitable trend-following strategies. From risk management tips to hands-on practice sessions, this program equips you with the skills needed to navigate markets confidently and achieve your learn-to-trade stocks goals.

- Unlocking Market Insights: The Carlton Training Approach

- Identifying Trends: Tools and Techniques for Traders

- Interpreting Data: Recognizing Pattern and Signals

- Strategies for Profitable Trading: Trend Following

- Risk Management in Trending Markets

- Practicing and Refining Your Skills: Hands-On Experience

Unlocking Market Insights: The Carlton Training Approach

At Carlton, we understand that staying ahead in the complex world of trading requires more than just knowledge; it demands a deep, intuitive grasp of market trends. Our training programs are designed to unlock these insights by empowering participants with cutting-edge analytical tools and strategies. We don’t merely teach how to trade stocks; we equip individuals with the skills to interpret market data, identify patterns, and make informed decisions in real time.

Our approach focuses on immersive learning experiences that bridge theory and practice. Through interactive simulations, case studies of successful trades, and peer-to-peer discussions, participants gain hands-on experience navigating the market’s intricacies. By the end of our training, individuals not only learn to trade stocks but also cultivate a strategic mindset that allows them to anticipate shifts, capitalize on opportunities, and navigate even the most volatile markets with confidence.

Identifying Trends: Tools and Techniques for Traders

Identifying market trends is a crucial skill for anyone looking to learn to trade stocks successfully. Traders use various tools and techniques to spot patterns and predict future price movements. One popular method involves analyzing historical data, such as past stock prices and trading volumes, to uncover recurring trends. By studying these patterns, traders can make informed decisions about when to buy or sell.

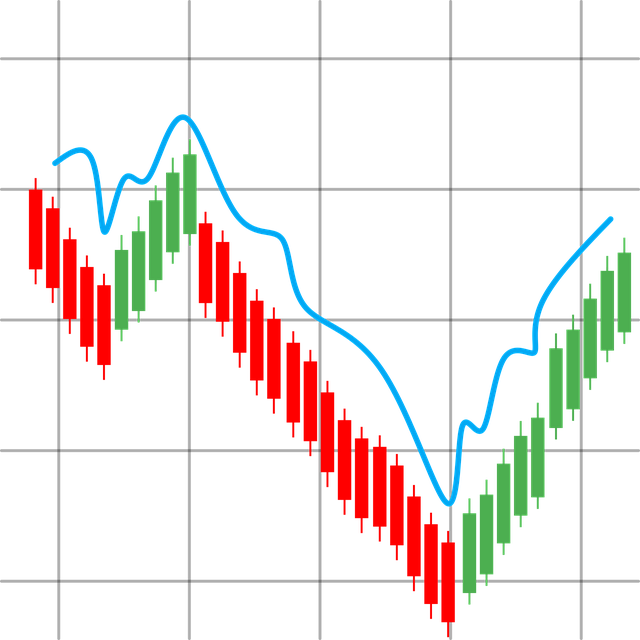

Technical analysis is another powerful tool that helps in identifying trends. This involves utilizing charts and indicators to visualize market behavior. Traders often rely on moving averages, relative strength indexes (RSI), and other technical indicators to identify support and resistance levels, which can signal potential turning points in the market. Staying updated with these tools and techniques empowers traders to adapt quickly to changing market conditions and improve their chances of successful stock trading.

Interpreting Data: Recognizing Pattern and Signals

In the world of learning to trade stocks, interpreting data is a vital skill. It involves recognizing patterns and signals within market trends, which can provide valuable insights for informed decision-making. By closely examining historical price movements, trading volumes, and other relevant indicators, traders can identify recurring motifs that may foreshadow future behaviors. This process demands keen observation and the ability to discern subtle nuances in data points.

Traders who excel at interpreting data often develop a keen eye for recognizing patterns, such as rising trends, falling markets, or consolidation phases. They learn to identify key signals like moving averages, relative strength indexes (RSIs), and MACD histograms, which can act as early indicators of potential shifts in market conditions. Understanding these patterns and signals is not just about technical analysis; it’s a strategic approach to anticipating market movements, enabling traders to make more calculated decisions in their quest to navigate the dynamic landscape of stock trading.

Strategies for Profitable Trading: Trend Following

In the dynamic world of trading, understanding market trends is a game-changer. Carlton’s training provides a robust framework for aspiring traders to master this art. One powerful strategy that traders can learn is trend following – a method that involves capitalizing on the direction of an existing market trend. By identifying and riding these trends, investors can significantly enhance their profitability. This approach requires a keen eye for recognizing consistent patterns and a disciplined strategy to capture gains.

Traders who master trend following gain valuable insights into when to enter and exit positions, allowing them to make informed decisions in the fast-paced market. It’s an essential skill for anyone looking to learn to trade stocks successfully. Through Carlton’s guidance, trainees can explore various indicators and tools that aid in identifying trends, ensuring they stay ahead of the curve in this ever-evolving financial landscape.

Risk Management in Trending Markets

In the dynamic landscape of learn to trade stocks, understanding market trends is only half the battle. Effective risk management becomes paramount as investors navigate through periods of rapid change and uncertainty. Carlton’s training on this front equips participants with strategies to mitigate potential losses while capitalizing on opportunities. By fostering a disciplined approach, traders learn to identify and assess risks associated with various market conditions, ensuring their decisions are informed and calculated.

This involves mastering techniques such as setting stop-loss orders, diversifying portfolios, and employing risk-reward ratios. Through practical exercises, students gain hands-on experience in applying these concepts, enabling them to adapt swiftly in fast-moving markets. Ultimately, Carlton’s risk management curriculum empowers traders to approach market trends with confidence, knowing they have the tools to protect their investments while pursuing substantial returns.

Practicing and Refining Your Skills: Hands-On Experience

To truly master learning to trade stocks, practical application is key. Hands-on experience allows individuals to refine their skills and gain a deeper understanding of market dynamics. Carlton’s training provides an immersive environment where trainees can put theories into practice, navigating various scenarios and adapting to real-time fluctuations. This hands-on approach fosters a more intuitive grasp of market trends, enabling traders to make informed decisions with increased confidence.

Through simulated trading exercises and guided mentorship, participants develop the ability to analyze charts, identify patterns, and execute trades effectively. By continuously practicing in a controlled setting, they enhance their technical skills while learning to manage risk and adjust strategies accordingly. This practical training equips aspiring stock traders with valuable experience, preparing them to navigate the complexities of the real market with precision and poise.

Carlton training equips traders with the tools to navigate volatile markets by learning to trade stocks effectively. Through a structured approach that combines insightful analysis, practical skills development, and risk management strategies, participants gain a competitive edge in understanding market trends. By mastering trend-following techniques and refining their skills through hands-on experience, they are empowered to make informed decisions, maximizing potential profits while mitigating risks in today’s dynamic financial landscape.