Unveiling the stock market's secrets is crucial for investors aiming to build wealth within. Investing in stocks involves purchasing shares of public companies, with knowledge of fundamental concepts like prices, trends, and sector performance enabling informed decision-making. Investing in stocks success hinges on fundamental analysis, which identifies undervalued assets by examining financial metrics and market dynamics, and technical analysis, which studies historical price patterns for trend anticipation. Diversifying investments across various asset classes and sectors further mitigates risk and maximizes returns, ensuring stability during volatility and unlocking wealth within.

Uncover the mysteries of stock investing and harness your path to financial growth. This comprehensive guide demystifies the stock market’s intricacies, from grasping fundamental analysis to deciphering technical charts. Learn how to identify company value drivers, recognize market trends, and build a balanced portfolio for maximum returns. Discover proven strategies to unlock wealth within the dynamic world of investing in stocks, ensuring long-term financial success.

- Demystifying Stock Market Basics: A Foundation for Success

- Unlocking the Power of Fundamental Analysis: Understanding Company Value

- Technical Analysis 101: Reading Charts and Identifying Trends

- Building a Balanced Portfolio: Diversification Strategies for Wealth Within

Demystifying Stock Market Basics: A Foundation for Success

The stock market can seem like a mysterious labyrinth for newcomers, but demystifying its basics is crucial for any investor aiming to unlock the potential for wealth within. Investing in stocks involves buying shares of publicly traded companies, becoming part-owners and standing to benefit from their growth and success. It’s a powerful tool that, when approached thoughtfully, can contribute significantly to financial goals. Understanding fundamental concepts like stock prices, market trends, and how different sectors perform is essential for making informed decisions.

By grasping these fundamentals, investors gain a solid foundation for navigating the market’s ups and downs. This knowledge enables them to identify promising opportunities, manage risk, and make strategic choices that align with their investment objectives. Whether it’s through research, consultation with financial advisors, or staying updated on economic news, building a strong grasp of stock market basics paves the way for successful investing and the potential for substantial returns.

Unlocking the Power of Fundamental Analysis: Understanding Company Value

Unlocking the secrets of stock investing begins with a deep dive into fundamental analysis, a powerful tool that helps investors uncover the true value of a company and make informed decisions. This analytical approach goes beyond surface-level trends and market noise to reveal the intrinsic worth of a business. By examining key financial metrics, industry position, competitive advantage, and management quality, investors can assess whether a stock represents a smart investment choice.

Understanding company value is the linchpin of successful investing in stocks. It empowers investors to identify undervalued assets that have the potential to generate significant wealth within. Fundamental analysis provides a roadmap, guiding investors through the complexities of financial statements and market dynamics to uncover hidden opportunities. When you can accurately determine a company’s worth, you’re better equipped to make strategic moves that align with your investment goals, ultimately enhancing your chances of achieving substantial returns.

Technical Analysis 101: Reading Charts and Identifying Trends

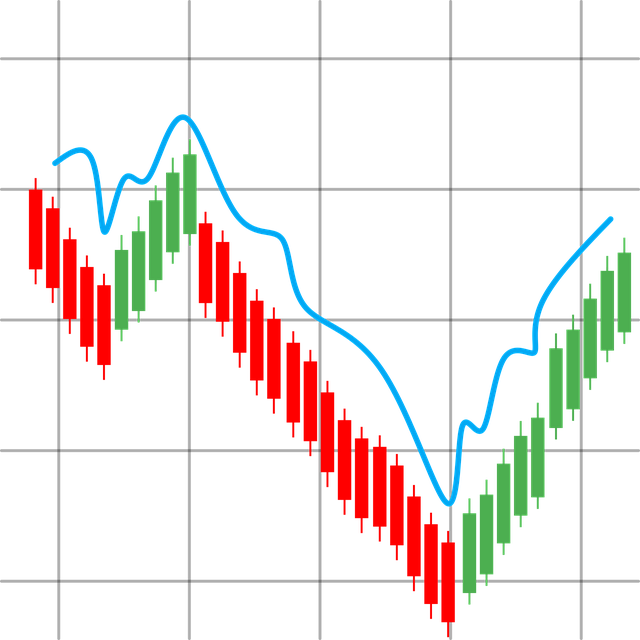

Technical analysis is a powerful tool for investors looking to unlock the secrets of stock investing and achieve wealth within the market. At its core, it involves studying historical price patterns and trading volumes to identify trends that can predict future price movements. By examining charts, traders can spot key indicators such as support and resistance levels, moving averages, and trend lines. These tools help investors make informed decisions about buying or selling stocks based on the market’s past performance.

Reading charts is like deciphering a language spoken by the market itself. Understanding candlestick patterns, for example, allows investors to gauge the strength of price movements. Identical patterns can repeat over time, offering insights into potential trends. Moreover, identifying correlation between different stocks or assets can help predict how they might perform together, diversifying your portfolio and enhancing your overall investing strategy.

Building a Balanced Portfolio: Diversification Strategies for Wealth Within

Building a balanced portfolio is a key strategy for investors aiming to unlock wealth within the stock market. Diversification, the cornerstone of this approach, involves spreading investments across various assets to mitigate risk and maximize returns. By not putting all eggs in one basket, investors can navigate market volatility with greater stability. This strategy ensures that even if one stock underperforms, others might compensate, providing a more consistent path to wealth accumulation.

Diversification can be achieved through different asset classes like stocks, bonds, real estate, and commodities, each offering unique risk and return profiles. Within the stock segment itself, diversifying across sectors, industries, and company sizes is equally vital. This approach allows investors to benefit from the growth potential of specific sectors while minimizing the impact of sector-wide downturns. A well-diversified portfolio not only protects against single-point failures but also opens doors to a broader range of investment opportunities, ultimately contributing to wealth within reach for savvy stock investors.

Investing in stocks is not just about predicting market trends but also understanding company fundamentals and interpreting charts. By demystifying these key concepts and strategies, individuals can unlock the potential for building sustainable wealth within their portfolios. Combining fundamental analysis, technical analysis, and diversification creates a robust framework for successful stock investing, enabling investors to navigate the markets with confidence and achieve their financial goals.