Investing in stocks is a viable path to building wealth within your financial portfolio. Understanding that stocks represent ownership shares in companies, success requires staying informed about company performance and market sentiment for strategic purchases with a long-term growth vision. Setting clear financial goals, assessing risk tolerance, and diversifying investments are crucial steps. By defining objectives, calculating required amounts, and investing consistently, you can accumulate wealth within years through a diverse portfolio of stocks from various sectors, minimizing risk and maximizing returns.

“Uncover the secrets to building your wealth within the stock market, even as a novice investor. This comprehensive guide is designed to empower beginners with the knowledge and tools for successful stock investment. From understanding the fundamentals of the stock market to diversifying your portfolio, we’ll navigate you through each step. Learn how to set clear financial goals and assess risks effectively. By the end, you’ll be equipped to make informed decisions and take the first strides towards generating substantial returns on your investments.”

- Understanding the Basics of Stock Investment

- Setting Clear Financial Goals as a Beginner

- Risk Assessment and Diversification Strategies

- Building Your Stock Portfolio Step-by-Step

Understanding the Basics of Stock Investment

Investing in stocks can seem intimidating at first, but grasping the fundamentals is a powerful step towards unlocking the potential for building wealth within your financial portfolio. Stocks represent ownership shares in publicly traded companies, and when you invest in them, you become a shareholder. This means you’re contributing to the company’s growth by providing capital in exchange for a piece of its future success. Understanding this basic concept is crucial for any novice investor looking to navigate the stock market.

The key to successful investing lies in recognizing that stock prices fluctuate based on various factors such as company performance, economic conditions, and market sentiment. By staying informed about these dynamics, you can make more informed decisions. Researching companies, analyzing their financial health, and understanding industry trends will empower you to identify promising investment opportunities. Remember, the goal is not just to buy stocks but to do so strategically, with a long-term vision for growth and profitability, thereby fostering wealth within your investment portfolio over time.

Setting Clear Financial Goals as a Beginner

As a novice investor, setting clear financial goals is a crucial step towards achieving wealth within your investment journey. Begin by defining what you want to accomplish—is it saving for retirement, funding your child’s education, or buying a home? Having specific, measurable objectives will guide your investment decisions and help you stay motivated. For instance, if your goal is to retire comfortably in 20 years, calculate the approximate amount you’ll need then and determine how much you can afford to invest monthly towards that target.

These goals should be tailored to your risk tolerance and time horizon. Be realistic; investing is a marathon, not a sprint. It’s about steady growth over time, so avoid setting short-term, aggressive targets that might lead to impulsive decisions. Instead, focus on consistent savings and smart allocation of funds, allowing your wealth to grow within the market’s natural fluctuations.

Risk Assessment and Diversification Strategies

When diving into the stock market as a novice, understanding risk assessment and diversification strategies is crucial for building a solid investment foundation. Before investing, assess your risk tolerance—how much financial loss you’re comfortable enduring. Stocks carry inherent risks; some investments are more volatile than others. If you’re risk-averse, opt for stable, established companies or consider mutual funds that spread your investment across various sectors. Diversification is key to managing risk and fostering wealth within. By diversifying your portfolio, you reduce the impact of any single stock’s poor performance. Invest in a mix of growth and value stocks, tech and traditional industries, domestic and international companies to create a well-rounded investment strategy that supports your financial goals.

Building Your Stock Portfolio Step-by-Step

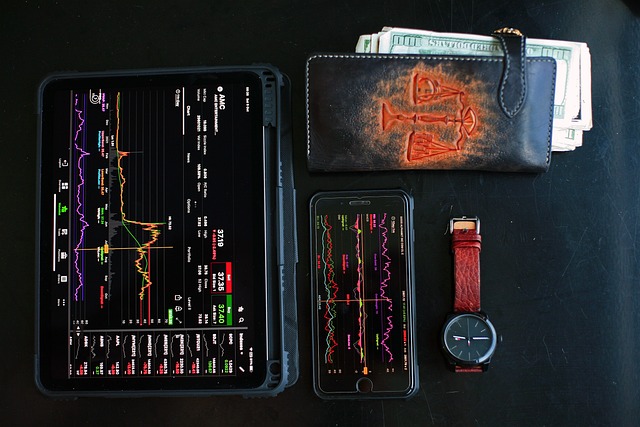

Starting your investment journey with stocks doesn’t have to be intimidating. Building a diverse portfolio is a strategic process that can help you achieve significant wealth within years, if executed correctly. Begin by defining your financial goals and risk tolerance; this will guide your decision-making throughout the process. Next, open a brokerage account with a reputable firm, choosing one that suits your needs and offers tools for beginners.

With your account set up, allocate time to research and learn about different sectors and industries. Identify companies you believe in and have strong growth potential. Start small, purchasing shares of these companies and gradually expanding your portfolio as you gain experience and confidence. Diversification is key; don’t put all your eggs in one basket, spread your investments across various sectors to mitigate risk and maximize returns over the long term.

Investing in stocks can seem daunting, but with a solid understanding of the basics, clear financial goals, thoughtful risk assessment, and diversified portfolio, you can begin your journey towards accumulating wealth within. By following these steps and staying informed, you’ll be well on your way to achieving your investment aspirations as a novice stock investor.