Learning the stock market involves understanding basic concepts like company ownership, supply and demand, and risk management through diversification. Beginners should start by educating themselves on financial fundamentals using online resources, practice with virtual trading, and open a brokerage account. Continuous learning through books, courses, news, and analysts is crucial for making informed decisions. Diversifying investments across sectors and asset classes minimizes risk, especially for newcomers who may prefer balanced portfolios. Regular portfolio rebalancing ensures alignment with investment goals.

Uncover the world of stocks and trading with our comprehensive guide, designed for aspiring investors. From understanding the fundamentals to navigating complex financial markets, this article equips beginners with essential knowledge. Learn where to start, grasp key concepts, explore effective strategies, and manage risks. Discover tools that facilitate your learning journey and unlock the potential of the stock market. Boost your investment wisdom and take charge of your financial future today.

- Understanding the Basics of Stocks and Trading

- Demystifying Financial Markets: Where and How to Begin

- Building a Solid Foundation: Essential Concepts for New Investors

- Strategies and Tools for Effective Stock Market Learning

- Risk Management and Diversification in Your Investment Journey

Understanding the Basics of Stocks and Trading

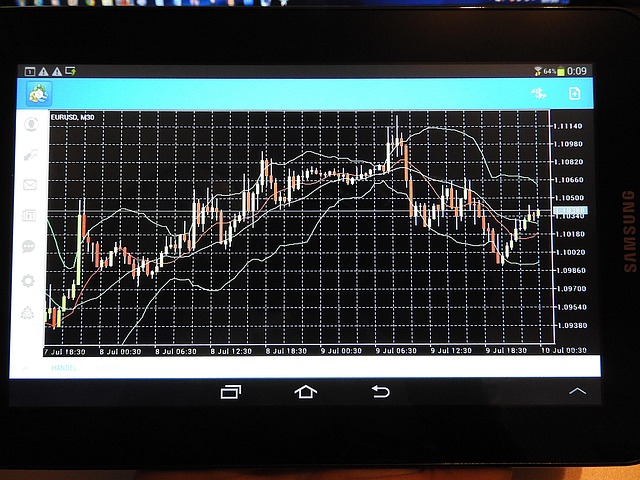

The stock market is a complex yet accessible realm for those eager to learn stock market fundamentals. At its core, trading stocks involves buying and selling shares of publicly traded companies. Each share represents a fraction of ownership in that business, offering investors potential financial gains through appreciation of the stock’s price or receipt of dividends. Understanding basic concepts like supply and demand, company performance, and market trends is essential for navigating this dynamic environment.

Initiating your journey in the learn stock market process involves selecting a brokerage account, researching companies, and making informed decisions based on analysis of financial statements, news, and industry insights. Diversification—spreading investments across various sectors or asset classes—is a crucial strategy to manage risk. By demystifying these basics and continually educating oneself, individuals can gain confidence in participating and potentially thriving within the stock market’s bustling landscape.

Demystifying Financial Markets: Where and How to Begin

Understanding financial markets is a journey that can empower individuals to make informed decisions about their money and future. For beginners, demystifying this complex world can seem daunting, but with a structured approach, it becomes an accessible and rewarding endeavor. The stock market, as a cornerstone of global finance, offers vast opportunities for growth and investment. To start learning, one should begin with the fundamentals: researching and educating themselves on basic financial concepts like assets, shares, stocks, bonds, and mutual funds. Online resources, books, and introductory courses are excellent tools to gain these initial insights.

Next, explore reliable platforms that provide a safe environment for practicing trading. Many websites offer virtual simulations, allowing users to learn stock market strategies without risk. As you grow more comfortable, consider opening a brokerage account with a regulated broker known for their beginner-friendly services. This step marks the transition from learning to active participation in the financial markets. Remember, patience and continuous learning are key; every trade is an opportunity to refine your skills and deepen your understanding of how the stock market operates.

Building a Solid Foundation: Essential Concepts for New Investors

For new investors, laying a strong foundation in the stock market is crucial for long-term success. The first step involves understanding the fundamentals of how the market works. This includes grasping key concepts like stock pricing, market trends, and company financial statements. By delving into these basics, investors can make informed decisions rather than relying on guesswork or fad investments.

Additionally, education is paramount. New investors should commit to learning about different investment strategies, risk management, and diversification. Numerous resources are available, from books and online courses to financial news outlets and market analysts. Investing time in acquiring knowledge equips individuals with the tools needed to navigate the stock market with confidence and make wise choices that align with their financial goals.

Strategies and Tools for Effective Stock Market Learning

Learning about the stock market can seem daunting at first, but with the right strategies and tools, anyone can become a savvy investor. One effective approach is to start with a solid foundation by understanding basic financial concepts like asset allocation, risk management, and diversification. This knowledge will empower you to make informed decisions when navigating the market.

Utilize a combination of resources for your learn stock market journey. Online courses and tutorials offer flexible learning at your own pace. Interactive platforms provide practical experience through virtual trading simulations. Additionally, invest in reputable financial news sources and books written by industry experts. These tools will not only enhance your understanding but also keep you informed about market trends and developments.

Risk Management and Diversification in Your Investment Journey

Embarking on your investment journey can be thrilling but also fraught with risk. A key strategy to navigate this landscape is understanding and implementing effective risk management techniques, especially through diversification. By spreading your investments across various assets, sectors, and markets, you mitigate the impact of any single investment’s poor performance. This approach ensures that a downfall in one area won’t necessarily sink your entire portfolio.

Diversification isn’t just about choosing different stocks; it involves a holistic view of your investment strategy. Consider factors like risk tolerance, investment goals, and time horizon. For instance, if you’re learning the stock market for the first time, a balanced portfolio with a mix of stocks, bonds, and cash might be more suitable than heavily focusing on high-risk investments. Regularly reviewing and rebalancing your portfolio is also crucial to stay aligned with your objectives.

Understanding the stock market is the first step towards achieving financial freedom. By grasping the basics, navigating financial markets, and employing effective learning strategies, new investors can build a solid foundation for their investment journey. Risk management and diversification are crucial tools to protect against volatility. Through continuous learning and adaptation, anyone can become proficient in the learn stock market and reap its benefits.