Melbourne's stock market is a dynamic hub offering diverse wealth creation opportunities within Australia's economy. By understanding local drivers like tourism, education, and property, investors can identify promising sectors like technology, sustainability, and healthcare. Diversification across stocks, bonds, and property minimizes risk and maximizes growth potential. Strategic planning, asset allocation, and regular portfolio reviews enable Melbournians to build and protect wealth within the competitive investment arena.

“Melbourne, a hub of economic vibrancy, offers an intriguing landscape for stock market investors seeking to build substantial wealth. This comprehensive guide unveils effective investment strategies tailored to Melbourne’s unique market dynamics. From understanding the local scene to diversifying your portfolio and identifying sector-specific opportunities, we navigate you through the process. Learn how asset allocation plays a pivotal role in managing risk and reward, and explore strategies for long-term wealth creation, ensuring your financial future is secure and prosperous.”

- Understanding Melbourne's Stock Market Landscape: A Gateway to Wealth Within

- Diversification Tactics for Optimal Investment Strategies

- Unlocking Growth Potential: Sector-Specific Opportunities in Melbourne

- Navigating Risk and Reward: Asset Allocation for Melburnians

- Long-Term Wealth Building: Retirement Planning and Stock Market Investments

Understanding Melbourne's Stock Market Landscape: A Gateway to Wealth Within

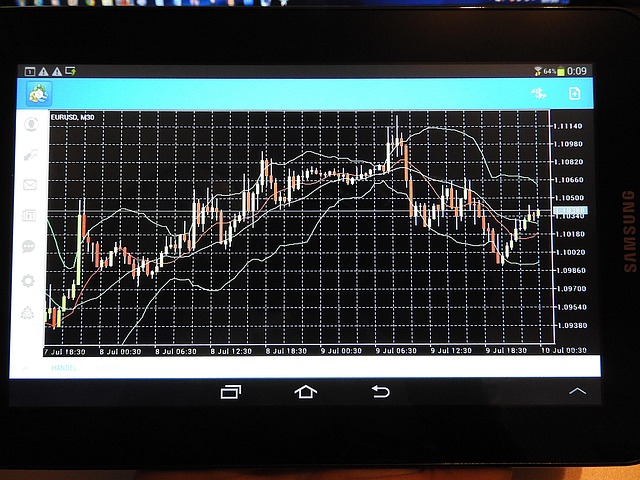

Melbourne’s stock market landscape is a vibrant and bustling hub, offering investors a gateway to immense wealth within Australia’s diverse economic tapestry. With a strong focus on innovation and a thriving business environment, Melbourne boasts numerous listed companies across various sectors, from technology and healthcare to finance and resources. This diversity presents investors with a wide range of opportunities to diversify their portfolios and mitigate risk.

Understanding the unique characteristics and trends of Melbourne’s stock market is crucial for unlocking its potential as a wealth creation tool. Local economic drivers, such as tourism, education, and a robust property market, provide a solid foundation for investment strategies. By navigating this landscape, investors can identify promising companies and sectors that align with their financial goals, ultimately contributing to the growth of their wealth within the dynamic Melbourne market.

Diversification Tactics for Optimal Investment Strategies

In Melbourne’s dynamic stock market, diversification is a powerful tool for investors aiming to build and preserve wealth within their portfolios. By spreading investments across various sectors, industries, and even geographic regions, investors can mitigate risk and enhance long-term growth potential. This strategy ensures that not all eggs are in one basket, allowing for greater stability during market fluctuations.

Diversification tactics enable investors to navigate the unpredictable nature of financial markets. It involves selecting a mix of stocks, bonds, and other assets to create a balanced portfolio. For instance, investing in technology, healthcare, and renewable energy sectors can provide exposure to growing industries while also offering protection against sector-specific downturns. Additionally, diversifying across international markets can further reduce risk and unlock opportunities for higher returns.

Unlocking Growth Potential: Sector-Specific Opportunities in Melbourne

Melbourne’s diverse economy offers investors a treasure trove of sector-specific opportunities, unlocking significant growth potential for those who know where to look. The city is a hub for technology, innovation and sustainability, with a thriving start-up culture and established industries in healthcare, clean energy, and education. Investing in these sectors can provide access to the wealth within Melbourne’s burgeoning ecosystem, as well as contribute to global trends driving sustainable growth.

From agile biotech firms pushing the boundaries of medical research to renewable energy projects powering a greener future, Melbourne’s economic landscape is dynamic and full of promise. By focusing on these sector-specific opportunities, investors can position themselves to benefit from both rising markets and long-term, impactful changes, unlocking substantial returns while contributing to the city’s continued prosperity.

Navigating Risk and Reward: Asset Allocation for Melburnians

Navigating Melbourne’s stock market requires a strategic approach, especially when considering the city’s unique economic landscape. Melburnians can maximize their investment potential by understanding asset allocation – a key principle for balancing risk and reward. Diversifying investments across various asset classes like stocks, bonds, and property allows investors to construct a portfolio that aligns with their risk tolerance and financial goals.

This strategy enables Melburnians to access the potential for wealth within the dynamic Victorian market while mitigating risks. For example, allocating a portion of investments to blue-chip stocks known for stability can provide a solid foundation, while carefully selected high-growth assets could offer substantial returns over time. Balancing these elements is crucial for achieving long-term financial success in Melbourne’s competitive investment arena.

Long-Term Wealth Building: Retirement Planning and Stock Market Investments

Building wealth over the long term is a key goal for many investors, and Melbourne’s stock market offers opportunities to achieve substantial returns with careful planning. Retirement planning forms a significant part of this strategy, as it encourages investors to adopt a mindset of saving and investing for the future. By allocating funds into diverse stock market investments, individuals can create a solid financial foundation that will support them throughout retirement.

The Australian stock market provides a wide range of options, from blue-chip stocks to small-cap companies, each offering unique growth potential. A well-diversified portfolio, carefully curated to align with an investor’s risk tolerance and financial goals, is essential for long-term success. This involves regularly reviewing and rebalancing the portfolio to ensure it remains tailored to one’s needs as they evolve over time. Effective retirement planning, combined with a robust stock market strategy, can help Melbournians secure their financial future and achieve the wealth within they desire.

Melbourne’s stock market offers a unique and vibrant landscape for investors seeking to build their wealth within this dynamic city. By understanding the diverse sectors and employing strategic diversification, Melburnians can unlock significant growth potential. Effective risk management through asset allocation ensures a balanced approach, while long-term retirement planning further solidifies financial security. Embracing these strategies equips investors with powerful tools to navigate Melbourne’s market landscape and achieve their financial aspirations.