Stock trading offers a path to significant wealth within through buying and selling company shares. To succeed, investors must understand market analysis, risk profiles, capital allocation, diversification, and portfolio management. Accessing reliable information, employing effective strategies, and staying informed about market trends are key. Utilizing digital tools, learning from experienced traders, and mastering trading psychology enhance decision-making. By combining these elements, individuals can build a robust investment portfolio and achieve their financial aspirations.

Unlock the secrets of stock trading and harness the power of the market to build your wealth within. This comprehensive guide demystifies the complexities, starting with the fundamentals of trading and understanding your risk tolerance. Learn effective strategies for crafting a diverse investment portfolio, leveraging essential tools and resources, and navigate the psychological challenges that separate success from failure. By mastering discipline and emotion, you’ll be well on your way to achieving financial milestones.

- Demystifying Stock Trading: Unveiling the Basics

- Understanding Your Risk Profile: A Foundation for Success

- Strategies for Building a Solid Investment Portfolio

- Tools and Resources to Enhance Your Trading Journey

- The Psychology of Trading: Mastering Discipline and Emotion

Demystifying Stock Trading: Unveiling the Basics

Stock trading, often perceived as a complex and enigmatic realm, holds the key to unlocking significant wealth within. Demystifying this process begins with understanding its fundamental principles. At its core, stock trading involves buying and selling shares of publicly traded companies, allowing investors to participate in their growth and success. By owning stocks, individuals gain partial ownership of these businesses, entiting them to potential profit from their performance.

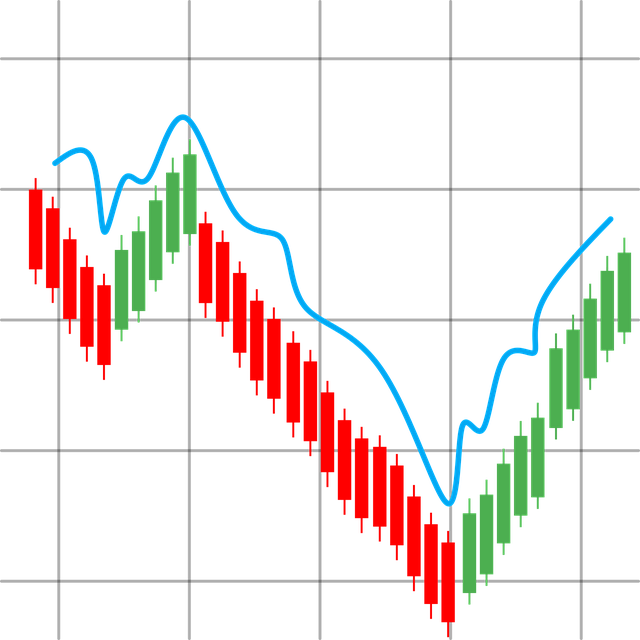

The basics revolve around market analysis, where traders study various factors such as financial statements, industry trends, and company news to make informed decisions. Key concepts like demand and supply dynamics, market trends, and technical indicators play a crucial role in predicting stock price movements. Accessing reliable information sources and utilizing effective trading strategies are essential steps for navigating this journey towards building wealth within the stock market.

Understanding Your Risk Profile: A Foundation for Success

Understanding your risk profile is a fundamental step in unlocking the secrets of stock trading and achieving wealth within. Before diving into the markets, it’s crucial to assess your personal tolerance for risk and financial goals. Every investor has a unique situation—some may prioritize short-term gains while others focus on long-term growth. By evaluating your comfort level with potential losses, you can set realistic expectations and develop a strategy aligned with your objectives.

This process involves considering factors like your age, income stability, and financial obligations. A more conservative investor might opt for lower-risk investments, focusing on steady growth, while a more aggressive trader may embrace higher-risk stocks for the chance at substantial returns. Defining your risk profile is a powerful tool that guides decision-making, ensuring you stay disciplined and make informed choices on your journey towards building wealth.

Strategies for Building a Solid Investment Portfolio

Building a solid investment portfolio is akin to crafting a well-balanced meal; it requires careful consideration and a strategic approach. The first step involves diversifying your investments across various asset classes like stocks, bonds, real estate, and commodities. This diversification not only reduces risk but also offers the potential for wealth within varying economic conditions. Start by allocating your capital based on your risk tolerance and investment goals—a prudent strategy that ensures your portfolio is aligned with your financial aspirations.

Next, focus on quality and value. Seek out companies with strong fundamentals, robust balance sheets, and consistent revenue growth. Investing in well-established, reputable firms can provide stability to your portfolio. Additionally, staying informed about market trends, keeping an eye on economic indicators, and being aware of industry developments will empower you to make insightful decisions, potentially unlocking significant wealth within the stock market.

Tools and Resources to Enhance Your Trading Journey

Embarking on your stock trading journey requires more than just a desire for financial freedom; it demands the right tools and resources to navigate the intricate landscape of markets effectively. Fortunately, in today’s digital era, an array of options is at your fingertips, empowering you to unlock the secrets of successful trading. From intuitive trading platforms offering real-time data and advanced analytics, to educational websites, podcasts, and online communities, these resources provide invaluable insights and guidance.

Delve into high-quality research tools that allow you to analyze company financials, track market trends, and identify potential investments. Platforms that offer customizable alerts for price movements or news updates can keep you ahead of the curve, enabling you to make informed decisions in a dynamic market environment. Additionally, leveraging the wisdom of experienced traders through online forums and mentorship programs can foster a deeper understanding of wealth creation within the stock market, providing a competitive edge as you chart your path to financial success.

The Psychology of Trading: Mastering Discipline and Emotion

Mastering the psychology of trading is a crucial step in unlocking the secrets to building wealth within the stock market. Trading is as much a mental game as it is a financial one; discipline and emotional control are the cornerstones of successful investing. Many traders fail not because of a lack of knowledge but due to their inability to stick to a strategy or let go of losses, driven by fear or greed.

The ability to maintain a disciplined approach, even in the face of market volatility, is essential. Traders must learn to recognize and overcome emotional biases that can cloud decision-making. By understanding and managing emotions, investors can make rational choices, stick to their trading plan, and ultimately, achieve their wealth-building goals. This inner strength allows traders to stay focused, patient, and consistent, which are key attributes in navigating the unpredictable nature of the stock market.

Unlocking the secrets of stock trading is more than just building wealth; it’s about understanding yourself, managing risk, and mastering discipline. By demystifying the basics, recognizing your risk profile, adopting effective investment strategies, leveraging useful tools, and navigating the psychology of trading, you can embark on a journey towards achieving your financial goals and unlocking the wealth within. Remember that consistent learning, adaptability, and emotional control are key to success in this dynamic landscape.