Newcastle share trading presents an exciting opportunity for individuals seeking financial freedom and growth. By understanding market intricacies, investing strategically, and adopting a long-term perspective, one can unlock substantial wealth. Key aspects include identifying high-potential stocks, effective risk management, diversification, and leveraging digital tools. Financial literacy is crucial, with Newcastle offering resources to educate aspiring traders. This comprehensive approach enables individuals to build and preserve wealth within the dynamic share market environment.

Newcastle share trading offers a powerful pathway to achieving long-term financial freedom and building substantial wealth. By understanding the fundamentals and adopting a strategic approach, investors can navigate the market effectively. This article delves into the key aspects of successful Newcastle share investing, including long-term strategies, risk management, choosing promising stocks, and leveraging educational resources. Discover how these elements combine to create a robust framework for generating wealth within the dynamic trading landscape.

- Understanding Newcastle Share Trading: A Gateway to Financial Freedom

- The Long-Term Perspective: Building Wealth Over Time

- Identifying High-Potential Stocks for Sustainable Growth

- Strategies for Risk Management and Diversification

- Utilizing Effective Trading Tools and Platforms

- Building a Solid Foundation: Education and Continuous Learning

Understanding Newcastle Share Trading: A Gateway to Financial Freedom

Newcastle share trading offers an exciting opportunity for individuals seeking to unlock their potential and achieve wealth within a dynamic financial landscape. It’s more than just buying and selling stocks; it’s a gateway to financial freedom and security. By understanding the intricacies of the market, investors can navigate the intricate paths of growth and profit, potentially transforming their economic future.

This strategy empowers folks to take control of their finances, enabling them to make informed decisions that align with their long-term goals. It involves learning about company fundamentals, market trends, and effective investment strategies. With the right approach, Newcastle share trading can be a powerful tool to generate substantial returns and create a solid foundation for future prosperity, ultimately fostering financial independence.

The Long-Term Perspective: Building Wealth Over Time

Investing in Newcastle’s stock market with a long-term perspective is a strategic move towards achieving substantial wealth. It involves adopting a patient mindset, allowing your investments to grow and mature over an extended period. This approach recognizes that building wealth is often a gradual process, requiring time for capital appreciation and compound interest to take effect. By focusing on the long term, investors can navigate market fluctuations with resilience, knowing that consistent contributions and well-selected investments will pay dividends in the future.

The beauty of this strategy lies in its ability to foster wealth within reach. Through regular trading and careful selection of stocks, individuals can create a diverse portfolio tailored to their financial goals. As Newcastle’s economic landscape evolves, so does the potential for growth across various sectors, providing ample opportunities for investors to capitalize on long-term trends and reap significant rewards.

Identifying High-Potential Stocks for Sustainable Growth

Identifying high-potential stocks is a crucial step in building long-term wealth through Newcastle share trading. To navigate this process effectively, investors should look beyond momentary market fluctuations and focus on companies with robust fundamentals and consistent growth trajectories. Researching industries with strong trends, innovative products or services, and competitive advantages can unveil promising opportunities. Additionally, understanding the company’s management team, financial health, and market positioning is essential for making informed decisions.

Investing in stocks with sustainable growth prospects allows investors to harness the power of compounding over time. By carefully selecting companies that are well-positioned to adapt to changing market conditions, investors can build a resilient portfolio that contributes to their overall wealth within. This strategic approach requires patience and discipline, but it paves the way for long-term financial success in the dynamic world of share trading.

Strategies for Risk Management and Diversification

Building wealth through share trading requires a strategic approach to risk management and diversification. By understanding your risk tolerance, setting clear investment goals, and adopting a well-balanced portfolio strategy, investors can navigate market fluctuations with confidence. One effective method is to diversify across various sectors and asset classes, spreading investments to reduce the impact of any single stock’s performance on overall wealth within the portfolio.

Additionally, implementing risk management techniques such as stop-loss orders, dollar-cost averaging, and regular portfolio rebalancing helps mitigate potential losses and ensures investments remain aligned with long-term goals. These strategies collectively contribute to a more stable investment journey, enabling individuals to accumulate and preserve wealth over time while navigating the dynamic nature of the share market.

Utilizing Effective Trading Tools and Platforms

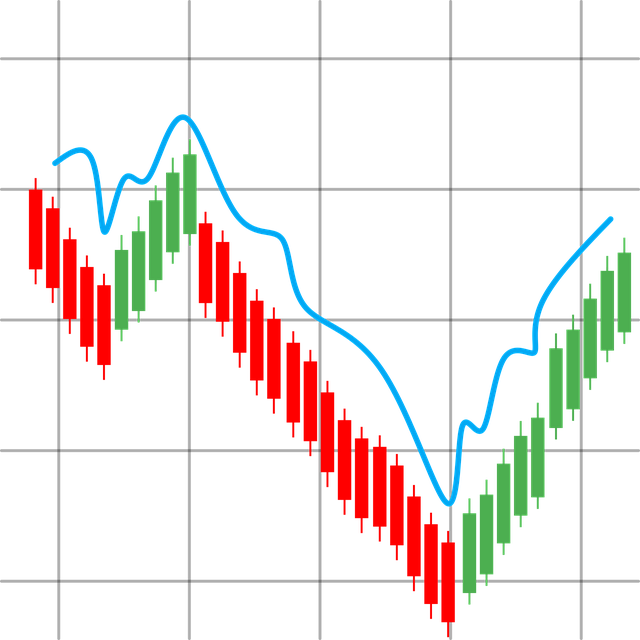

In the digital age, leveraging effective trading tools and platforms is paramount for navigating Newcastle’s share market and cultivating sustainable wealth within. Advanced software designed for stock trading offers users a competitive edge by providing real-time data analysis, sophisticated charting tools, and automated trading algorithms. These features empower investors to make informed decisions, capitalize on market trends, and execute trades with precision.

By embracing user-friendly platforms that cater to both beginners and seasoned traders, individuals can streamline their investment journey. Accessible mobile apps, intuitive interfaces, and comprehensive educational resources ensure a seamless experience, enabling investors to stay abreast of market fluctuations and strategically build their financial portfolios for long-term wealth accumulation.

Building a Solid Foundation: Education and Continuous Learning

Building a solid foundation for your financial future is paramount when navigating the complex world of share trading. Newcastle, with its thriving business landscape and robust educational institutions, provides an ideal environment to cultivate knowledge and skills essential for long-term wealth creation. Investing in yourself through continuous learning is a key strategy to unlock the potential for substantial gains in the stock market.

Education plays a pivotal role in empowering individuals to make informed decisions when trading shares. From introductory courses on financial markets to advanced seminars on investment strategies, Newcastle offers diverse learning opportunities. By staying abreast of market trends, understanding complex financial concepts, and mastering analytical tools, traders can develop a disciplined approach. This knowledge enables them to identify promising investment avenues, mitigate risks, and ultimately build wealth within the dynamic trading environment.

Newcastle share trading offers a powerful tool for achieving long-term financial goals and unlocking significant wealth within. By adopting a strategic approach that combines careful stock selection, robust risk management, and continuous learning, individuals can navigate the market effectively. This article has provided a comprehensive guide to help investors build a solid foundation, identify high-growth opportunities, and manage their portfolios successfully. Embracing these principles is key to transforming financial aspirations into reality and securing a prosperous future.